Two Types Of Rich

/What type of rich are you?

It was first thought that the economic fallout from the Coronavirus only affected blue-collar and low wage earners, but as data trickles in, it’s become apparent that COVID-19 has spared very few.

It's also become apparent in the last few months that one class of "Rich" has been hit more than the other since the virus hit our shores - with some genuinely struggling.

Society and tradition have ingrained in us a "prestige bias" towards those with high-paying and esteemed jobs.

Executives, doctors, lawyers, engineers are all viewed as having achieved the pinnacle of success and the American Dream because of their high wages and big houses.

What the rest of the public doesn’t see about high wage earners but what the Coronavirus has shed light on is that earning a high income doesn’t guarantee security in a downturn.

These high earners - the so-called "Working-Rich" - may make a lot of money but they also spend a lot of it too.

Their budgets and credit lines are often stretched to the limits to support freewheeling lifestyles that include big homes, fast cars, fancy clothes, private school tuitions, country club memberships, exotic vacations, etc.

The Working-Rich are wholly dependent on their jobs to support their lifestyles. To the outside world, the Working-Rich seem to have it made behind their gated communities; however, the reality is often far from perception. When wages stop or get cut, the lifestyles of the Working-Rich suffer.

On March 28, 2020, a Washington Post article highlighted how after the first wave of layoffs in the service sector due to the Coronavirus, it was tech, legal and other professionals that started to report layoffs, pay cuts, and furloughs.

Record unemployment is sparing no one, with high-income white-collar workers increasingly falling victim to the near-shutdown of the economy.

Outsiders assume the Working-Rich has nothing to worry about when they lose their jobs. They must have a bunch of savings to help them ride out any storm right? Wrong.

Most Working-Rich don’t have much savings at all and in a time of crisis, it’s the high earners that sharply curtail spending the most.

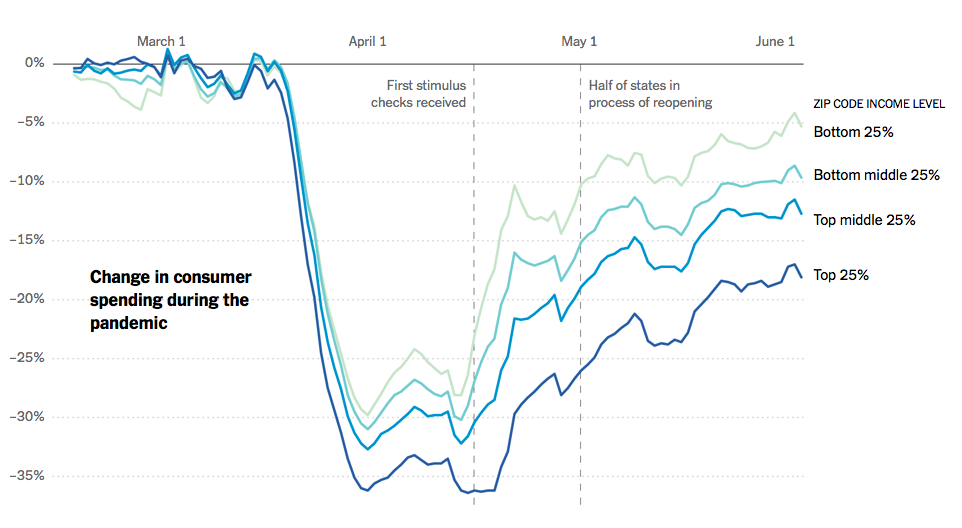

This graph from a recent New York Times article illustrates the steep spending cuts the Working-Rich implement when income is reduced. As the chart illustrates, the reductions in spending by high earners are more drastic than any other income group.

Another highlight of the chart above is that although the Working-Rich are quicker to cut spending in the face of a crisis, they are also slower to ramp spending back up once things start to normalize.

High-income earners like lawyers, executives, and doctors usually come raging out of graduation from law schools and MBA schools and completion of residencies respectively with a huge appetite for spending and indulging in highly anticipated luxuries after years of struggle as students.

Unfortunately, many of these high earners never receive good counsel on how to manage their newly found high incomes and as a consequence, their wagers barely meet their expenses.

The pandemic has exposed the vast divide between the two types of "Rich." While the Working-Rich are at risk financially due to potential job loss, there’s another class of Rich that is not dependent on their jobs to sustain their lifestyles.

This class of Rich is not dependent on their jobs for income.

That’s because the "Asset-Rich" learned long ago not to rely on their jobs for income. Many likely suffered through a previous recession and saw their livelihoods disappear with their jobs, but they learned an important lesson from their past struggles.

The Asset-Rich learned that if they didn’t figure out a way to generate multiple streams of passive income, they’d always be exposed financially in a crisis or recession.

Most of the Asset-Rich started out in the same boat as the Working-Rich.

They just received wise counsel along the way that advised them to invest in cash-flowing assets insulated from a loss of income. That way, if they ever lost their jobs or ever became incapacitated, their passive income investments would continue to sustain their lifestyles.

Becoming Asset-Rich requires a shift in priorities.

While the Working-Rich are income-focused, the Asset-Rich are net-worth focused.

The Working-Rich collect toys that accumulate debt.

The Asset-Rich collect assets that accumulate wealth.

The Asset-Rich will always ask themselves if an asset they commit capital to will build up wealth or whether it will take from it.

Shifting to passive income investments allows the Asset-Rich to sever their dependency on active income from their jobs. This is why the Asset-Rich maintain their lifestyles and spending in a time of crisis while the Working-Rich will sharply curtail theirs.

Because the Working-Rich rely on their wages to cover their high spending habits, it’s not surprising that many live paycheck-to-paycheck.

As a result, many modify their spending habits sharply when disaster hits and they stop earning a paycheck.

The Asset-Rich are different because they don’t depend on wages to sustain their lifestyles. They work because they want to and not because they have to. That’s because their focus on net-worth has veered them towards cash-flowing tangible assets that produce in any economic environment.

Hopefully, we’ve made clear that the one major difference between the Working-Rich and the Asset-Rich is passive income.

Passive income comes from having your money work for you 24 hours a day, even while you’re sleeping.

The Working-Rich work for their money. With the wealthy, it’s the other way around. The money works for them.

Examples of passive income investments include:

Commercial Real Estate.

Productive Business Interests.

Passive income-generating real estate is a favorite of the Asset-Rich because when a crisis hits, while wages may disappear, rents collected from real estate endures.

People don’t stop needing shelter and businesses don’t stop needing office and retail space. This is why the Asset-Rich survive recessions and many of the Working-Rich don’t.

Ask yourself:

Where is your focus?

Is it on making a high income or building net-worth?

If you lose your job, will your lifestyle change?

If you answered yes to the last question, maybe it’s time to consider accumulating assets that build wealth and not debt.

Investing for your future,

Logan Freeman